NCERT Solution class 11 accounts Chapter 3: Recording of Transactions – I

NCERT Solutions for Class 11 accounts has enabled the students to be oriented and familiar with the first steps of the accounting cycle. In this whole chapter, the process of recording every financial transaction in the book of accounts is explained. It includes the preparation of some necessary topics like journal entries, ledgers and the way trial balances are prepared for proper accounting.

Download PDF For NCERT Solutions for Accountancy Recording of Transactions–I

The NCERT Solution class 11 accounts Chapter 3: Recording of Transactions – I are tailored to help the students master the concepts that are key to success in their classrooms. The solutions given in the PDF are developed by experts and correlate with the CBSE syllabus of 2023-2024. These solutions provide thorough explanations with a step-by-step approach to solving problems. Students can easily get a hold of the subject and learn the basics with a deeper understanding. Additionally, they can practice better, be confident, and perform well in their examinations with the support of this PDF.

Download PDF

Access Answers to NCERT Solution class 11 accounts Chapter 3: Recording of Transactions – I

Students can access the NCERT Solution class 11 accounts Chapter 3: Recording of Transactions – I. Curated by experts according to the CBSE syllabus for 2023–2024, these step-by-step solutions make Accountancy much easier to understand and learn for the students. These solutions can be used in practice by students to attain skills in solving problems, reinforce important learning objectives, and be well-prepared for tests.

Recording of Transactions – I

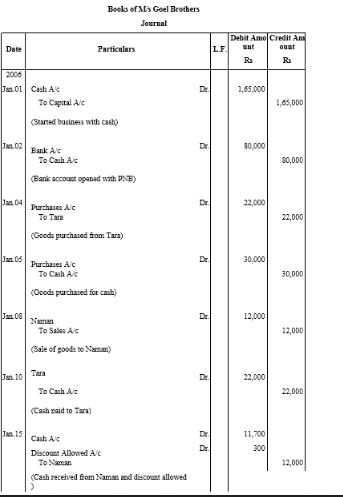

Give a specimen of an account.

State the three fundamental steps in the accounting process.

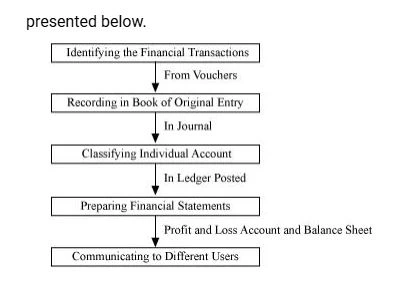

The fundamental steps in the accounting process are diagrammatically

Why is the evidence provided by source documents important to accounting?

The evidence provided by the source document is important in the following manners:

1. It provides evidence that a transaction has actually occurred.

2. It provides important and relevant information about date, amount, parties involved and other details of a particular transaction.

3. It acts as a proof in the court of law.

4. It helps in verifying transactions during the auditing process.

Should a transaction be first recorded in a journal or ledger? Why?

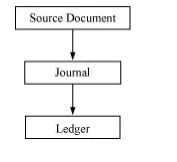

A transaction should be recorded first in a journal because the journal provides complete details of a transaction in one entry. Further, a journal forms the basis for posting the transactions into their respective accounts into ledger. Transactions are recorded in a journal in chronological order, i.e. in the order of occurrence with the help of source documents. Journal is also known as ‘book of original entry’, because with the help of source documents, transactions are originally recorded in books. The process of recording the transactions in journal and then in ledger is presented in the below given

flow chart.

Are debits or credits listed first in journal entries? Are debits or credits indented?

As per the rule of double entry system, there are two columns of ‘Amount’ in the journal format namely ‘Debit Amount’ and ‘Credit Amount’. The way of recording in a journal is quite different from normal recording. Journal entry is recorded in journal format in which the ‘Debit Amount’ column is listed before the ‘Credit Amount’ column. Credits are indented. Indentation is leaving a space before writing any word. Journal entry has its own jargon. While journalising, in the ‘Particulars’ column of journal format, debited account is written first and credited account is in the next line leaving some space, which is indentation.

Why are some accounting systems called double accounting systems?

Some accounting systems are called double accounting systems because under this system there are two aspects of every transaction, i.e., every transaction has a dual effect. Every transaction affects two accounts simultaneously, that is represented by debiting one account and crediting the other account. It is based on the fact that if there is a receiver, there should be a giver.

Why are the rules of debit and credit the same for both liability and capital?

Every business acquires funds from internal as well as from external sources. According to the business entity concept, the amount borrowed from the external sources together with the internal sources like capital invested by the proprietor, is termed as liability to the business. Business entity concept treats business and business owner separately. Capital of the owner is treated as liability to the business because the business has to repay the amount of capital to the owner, in case of closure of the business. As liability incurred is credited, in the same way, fresh capital is introduced and net profit increases the owner’s capital, and so, capital is credited. On the other hand, if liability is paid, it reduces liability, and so, it is debited. Similarly, drawings from capital and net loss reduce the capital, and so, capital is debited. Thus the rules of debit and credit are the same for both liability and capital.

What is the purpose of posting J.F numbers that are entered in the journal at the time entries are posted to the accounts?

J.F. number is the number that is entered in the ledger at the time of posting entries into their respective accounts. It helps in determining whether all transactions are properly posted in their accounts. It is recorded at the time of posting and not at the time of recording the transactions.

The purpose of entering J.F. number in the ledger is because of the below given benefits.

1. J.F. number helps in locating the entries of accounts in the journal book. In other words, J.F number helps to locate the position of the related journal entry and subsidiary book in the journal book.

2. J.F. number in accounts ensures that recording in the books of original entry has been posted or not.

What entry (debit or credit) would you make to: (a) increase revenue (b) decrease in expense, (c) record drawings (d) record the fresh capital introduced by the owner.

1. Increase in revenue

Increase in revenue is credited as it increases the capital. Capital has credit balance and if capital increases, then it is credited.

2. Decrease in expense

Decrease in expense is credited as all expenses have debit balance. If expense decreases, then it is credited.

3. Record drawings

Capital has credit balance; if the capital increases, then it is credited. If capital decreases, then it is debited. Drawings are debited as they decrease the capital.

4. Record of fresh capital introduced by the owner- credit

Capital has credit balance, if capital increases, then it is credited. The introduction of fresh capital increases the balance of capital, and so, it is credited.

If a transaction has the effect of decreasing an asset, is the decrease recorded as a debit or as a credit? If the transaction has the effect of decreasing a liability, is the decrease recorded as a debit or as a credit?

If a transaction has a decreasing effect on an asset, then this decrease is recorded as credit. This is because, as all assets have debit balance and if assets decrease, then it is credited. For example, sale of furniture results in decrease in furniture (asset); so, the sale of furniture will be credited.

If a transaction has a decreasing effect on a liability, then this decrease is recorded as debit. This is because all liabilities have credit balance. If the liability increases, then it is credited and if the liability decreases, then it is debited. For example, payment to the creditors results in a decrease in the creditors (liability); so, the creditors account will be debited.

Numerical Questions

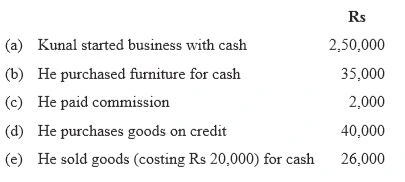

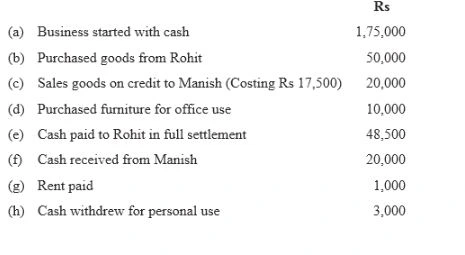

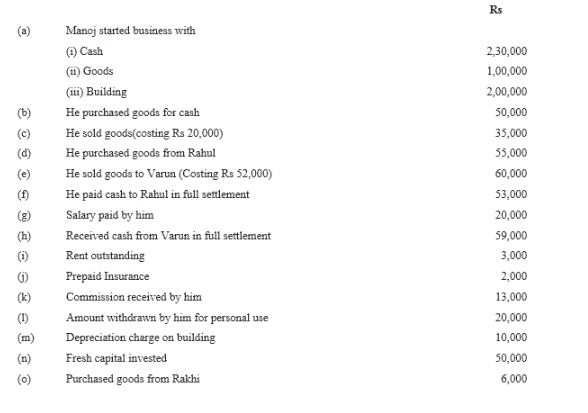

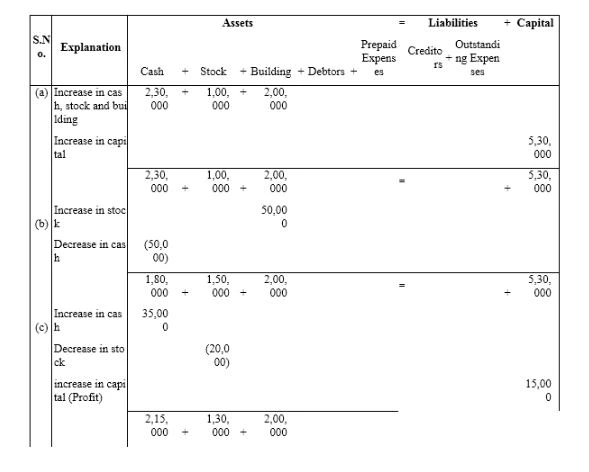

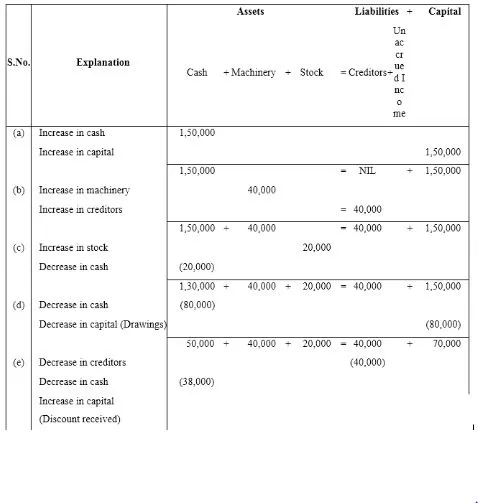

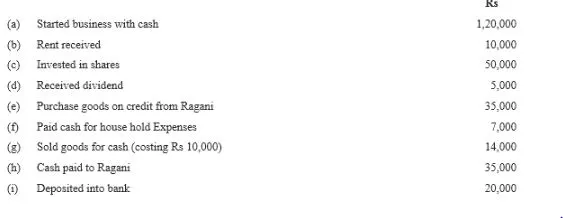

Prepare accounting equation from the following:

Mohit has the following transactions, prepare accounting equation:

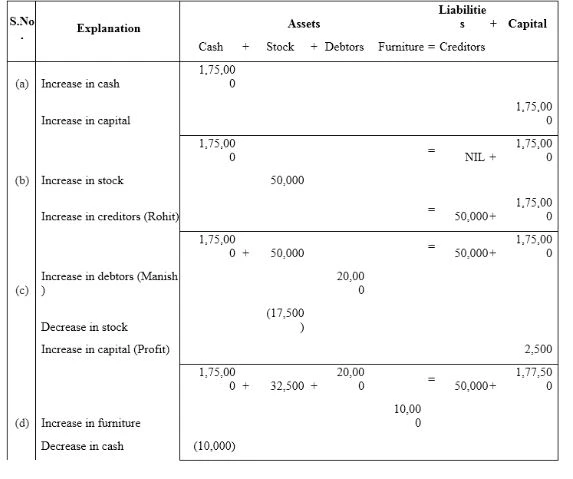

Show the accounting equation on the basis of the following transaction:

Show the effect of the following transaction on the accounting equation

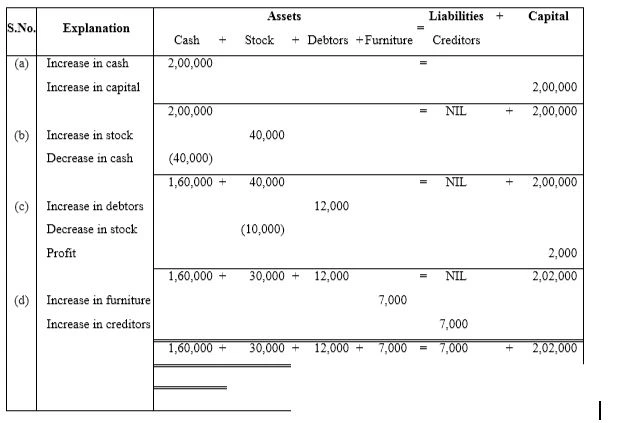

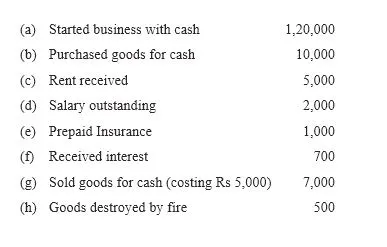

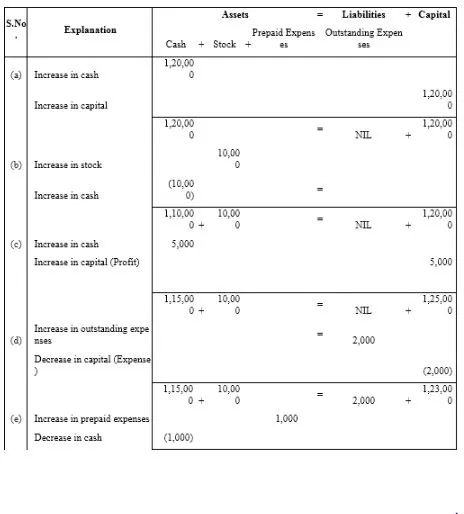

Prepare accounting equation on the basis of the following:

(a) Harsha started business with cash Rs 2,00,000

(b) Purchased goods from Naman for cash Rs 40,000

(c) Sold goods to Bhanu costing Rs 10,000/- Rs 12,000

(d) Bought furniture on credit Rs 7,000

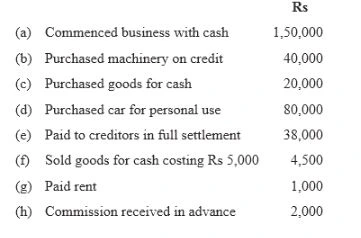

Rohit has the following transactions:

Prepare the Accounting Equation to show the effect of the above transactions on the assets, liabilities and capital.

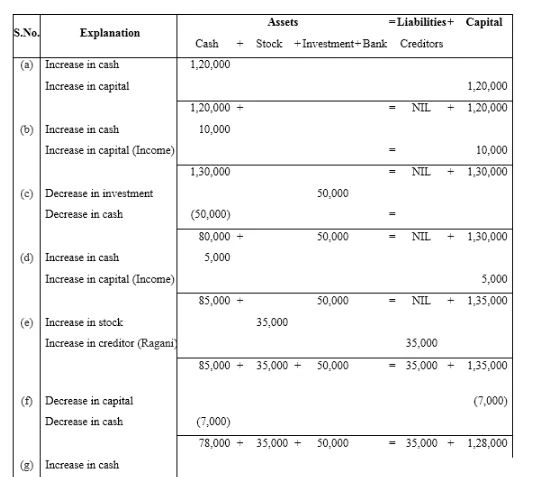

Use accounting equation to show the effect of the following transactions of M/s Royal Traders:

Show the effect of the following transactions on Assets, Liabilities and Capital through accounting equation:

Transactions of M/s. Vipin Traders are given below.

Show the effects on Assets, Liabilities and Capital with the help of accounting Equation.

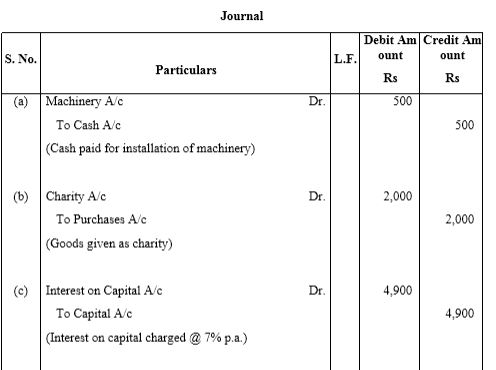

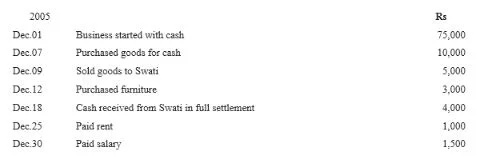

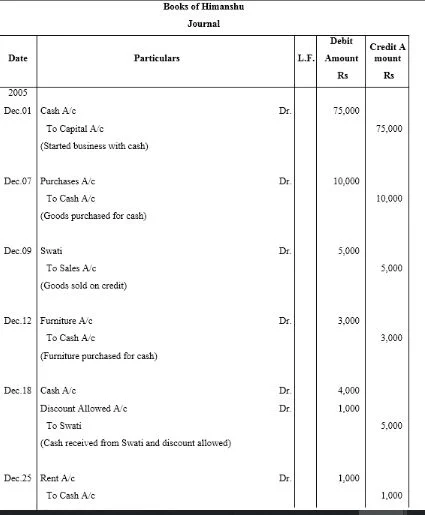

Journalise the following transactions in the books of Himanshu:

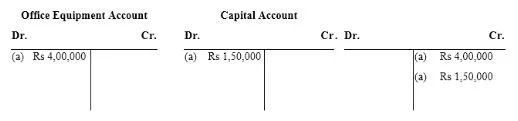

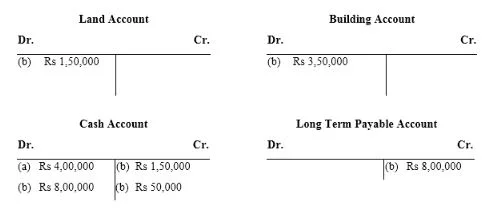

Bobby opened a consulting firm and completed these transactions during November, 2005:

(a) Invested Rs 4,00,000 cash and office equipment with Rs 1,50,000 in a business called Bobbie Consulting.

(b) Purchased land and a small office building. The land was worth Rs 1,50,000 and the building worth Rs 3,50,000. The purchase price was paid with Rs 2,00,000 cash and a long term note payable for Rs 8,00,000.

(c) Purchased office supplies on credit for Rs 12,000.

(d) Bobbie transferred title of motor car to the business. The motor car was worth Rs 90,000.

(e) Purchased for Rs 30,000 additional office equipment on credit.

(f) Paid Rs 75,00 salary to the office manager.

(g) Provided services to a client and collected Rs 30,000

(h) Paid Rs 4,000 for the month’s utilities.

(i) Paid supplier created in transaction (c).

(j) Purchase new office equipment by paying Rs 93,000 cash and trading in old equipment with a recorded cost of Rs 7,000.

(k) Completed services of a client for Rs 26,000. This amount is to be paid within 30 days.

(l) Received Rs 19,000 payment from the client created in transaction (k).

(m) Bobby withdrew Rs 20,000 from the business.

Analyse the above stated transactions and open the following T-accounts:

Cash, client, office supplies, motor car, building, land, long term payables, capital, withdrawals, salary, expense and utilities expense.

(a) The transaction (a) increases assets by Rs 5,50,000 (cash Rs 4,00,000 and office equipment Rs 1,5,000) it will be debited and on the other hand it will increase the capital by Rs 5,50,000, so it will be credited in capital account.

(b)

Purchase of land and small office building are assets. On one hand, the purchase of these items will increase their individual accounts and this will increase the total amount of the assets in the business; so, both the accounts will be debited. On the other hand, payment in cash on the purchase of these assets will decrease the cash balance, so cash account will be credited to the extent of amount paid. After payment for building in cash, the balance of building account will be transferred to creditors for building account. This will increase the amount of the creditors, which in turn will increase the total liabilities of the business. Long term payables are regarded as loan to the business that will increase both cash balance (due to intake of loan) as well as liabilities of the business.

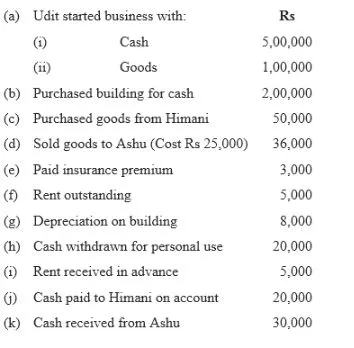

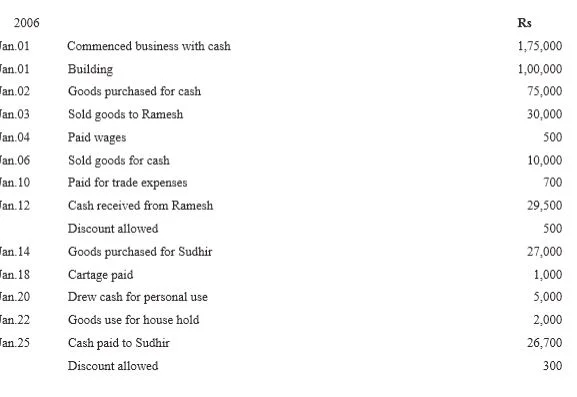

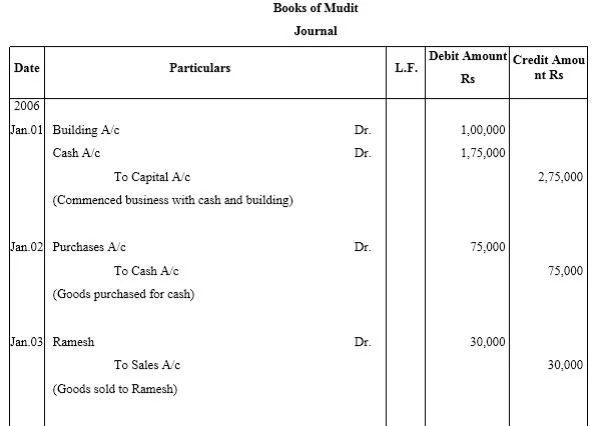

Enter the following Transactions in the Journal of Mudit :

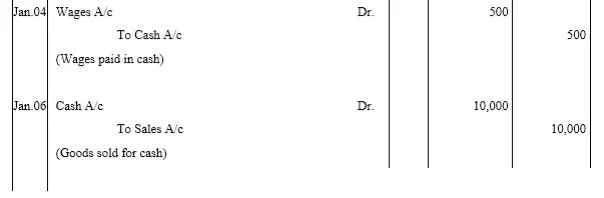

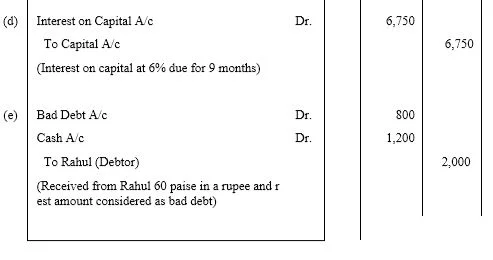

Jouranlise the following transactions in the books of Harpreet Bros.:

(a) Rs 1,000 due from Rohit are now bad debts.

(b) Goods worth Rs 2,000 were used by the proprietor.

(c) Charge depreciation @ 10% p.a for two month on machine costing Rs 30,000.

(d) Provide interest on capital of Rs 1,50,000 at 6% p.a. for 9 months.

(e) Rahul become insolvent, who owed is Rs 2,000 a final dividend of 60 paise in a rupee is received from his estate.

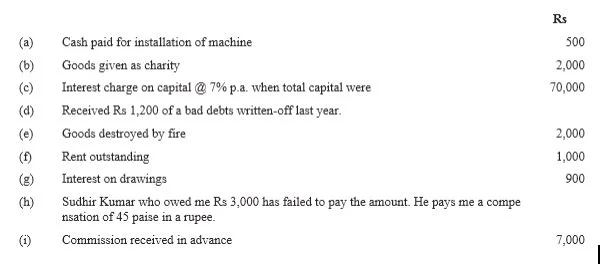

Prepare Journal from the transactions given below :

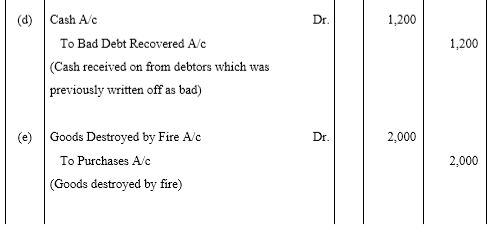

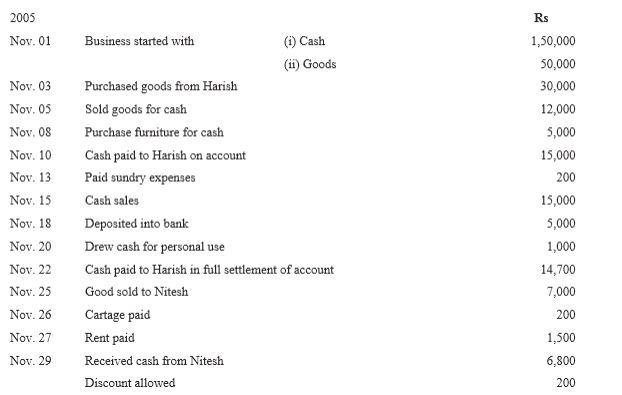

Journalise the following transactions, post to the ledger:

Nov.30 Salary paid 3,000

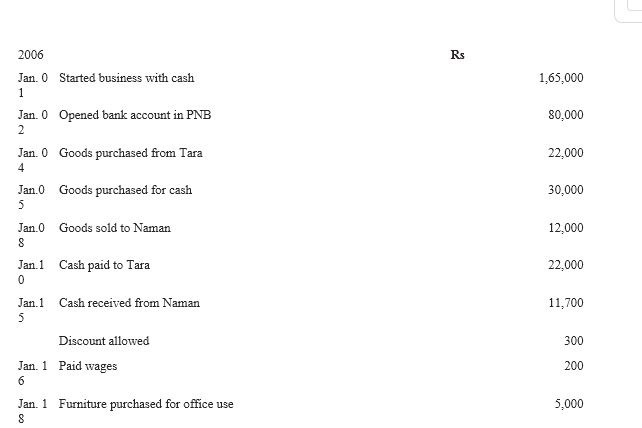

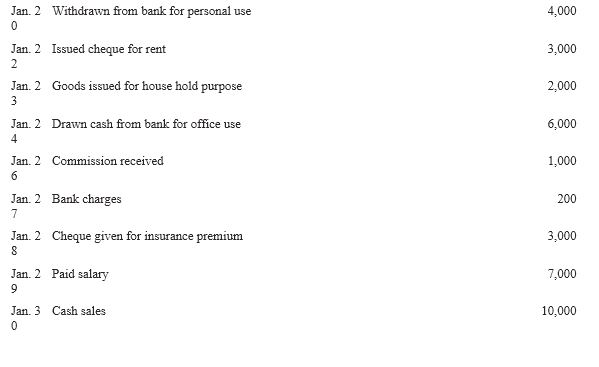

Journalise the following transactions is the journal of M/s. Goel Brothers and post them to the ledger.

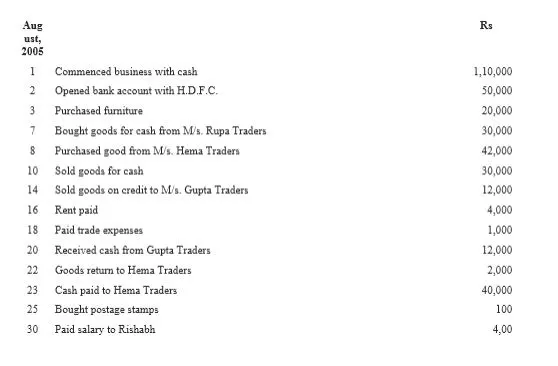

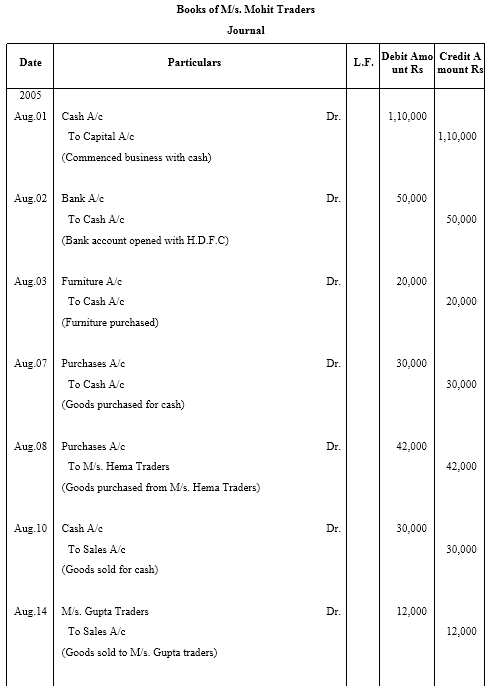

Give journal entries of M/s. Mohit traders; post them to the Ledger from the following transactions:

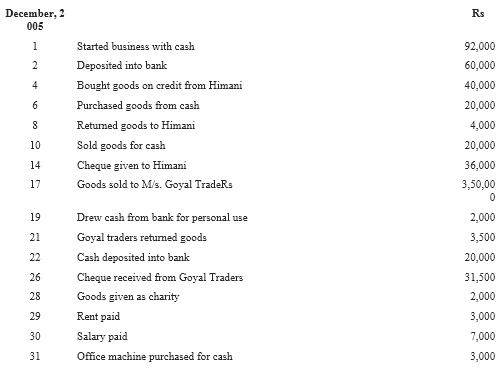

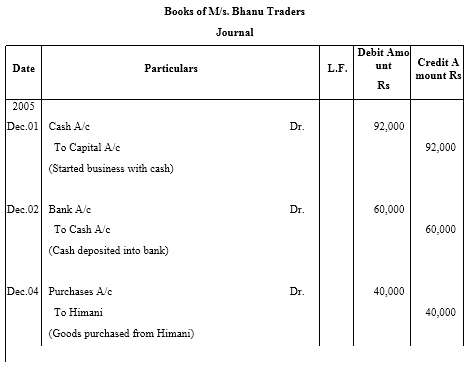

Journalise the following transaction in the Books of the M/s. Bhanu Traders and Post them into the Ledger.

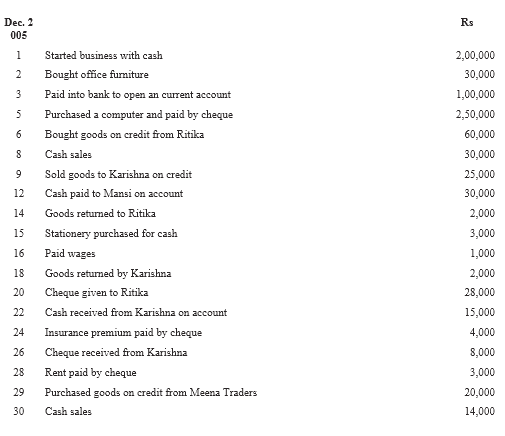

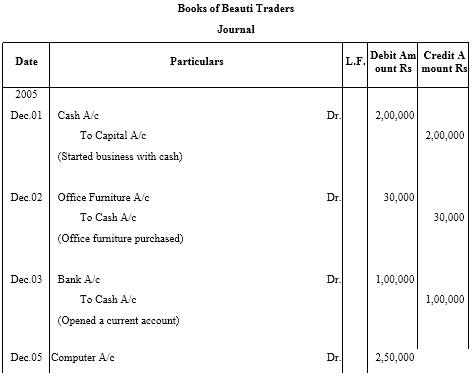

Journalise the following transaction in the Book of M/s. Beauti tradeRs Also post them in the ledger.

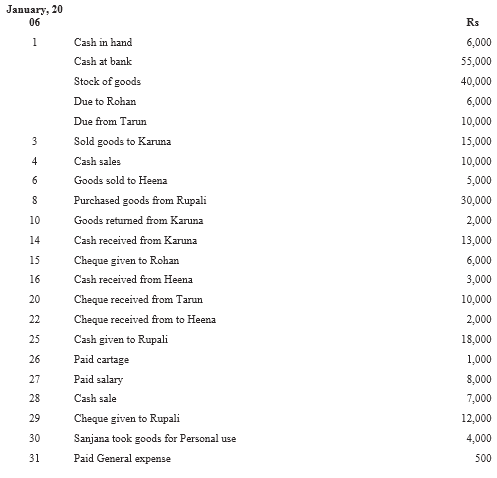

Journalise the following transaction in the books of Sanjana and post them into the ledger:

.webp)

Describe the events recorded in accounting systems and the importance of source documents in those systems?

It is beyond human capabilities to memorise each financial transaction and that is why, source documents have their own importance in accounting system. They are considered as an evidence of transactions and can be presented in the court of law. Transactions supported by evidence can be verified. Source documents also ensure that transactions recorded in the books are free from personal biases.

A few events that are supported by source document are given below.

1. Sale of goods worth Rs 200 on credit, supported by sales invoice/bill

2. Purchase of goods worth Rs 500 on credit, supported by purchase invoice/bill

3. Cash sales worth Rs 1,000, supported by cash memo

4. Cash purchase of goods worth Rs 400, supported by cash memo

5. Goods worth Rs 100 returned by customer, supported by credit note

6. Return of goods purchased on credit worth Rs 200, supported by debit note

7. Payment worth Rs 1,200 through bank, supported by cheques

8. Deposits into bank worth Rs 500, supported by pay-in slips.

Out of the above events, only those events that can be expressed in monetary terms, are recorded in the books of accounts. However, the non-monetary events are not recorded in accounts; for example, promotion of manger cannot be recorded but increment in salary can be recorded at the time when salary is paid or due.

Source document in accounting is important because of the below given reasons.

1. It provides evidence that transaction has actually occurred.

2. It provides information about the date, amount and parties involved and other details of a particular transactions.

3. It acts as an evidence in the count of law.

4. It helps in verifying the transaction during the auditing process.

Describe how debits and credits are used to analyse transactions.

Debit originated from the Italian word debito, which in turn is derived from the Latin word debeo, which means ‘owed to proprietor’ and credit comes from the Italian word credito, which is derived from the Latin word credo, which means belief, i.e., ‘owed by proprietor’.

According to the dual aspect concept, all the business transactions that are recorded in the books of accounts, have two aspects- debit and credit. The dual aspect can be better understood by the help of an example; bought goods worth Rs 500 on cash. This transaction affects two accounts with the same amount simultaneously. As goods are brought in exchange of cash, so the cash balances in the business reduce by Rs 500, i.e. why the cash account is credited. Simultaneously, the amount of goods increases by Rs 500, so purchases account will be debited. Debit and credit depend on the nature of accounts involved; such as assets, expenses, income, liabilities and capital. There are five types of Accounts.

1. Assets- These include all properties or legal rights owned by a firm for its operations, such as cash in hand, plant and machinery, bank, land, building, etc. All assets have debit balance. If assets increase, they are debited and if assets decrease, they are credited.

For example, furniture purchased and payment made by cheque. The journal entry is:

Furniture A/c Dr.

To Bank A/c

Here, furniture and bank balance, both are assets to the firm. As furniture is purchased, so furniture account will increase, and will be debited. On the other hand, payment of furniture is being made by cheque that reduces the bank balance of the business, so bank account will be credited.

2. Expense- It is made to run business smoothly and to carry day to day business activites.

All expenses have debit balance. If an expense is incurred, it must be debited.

For example, rent paid. The journal entry is:

Rent A/c Dr.

To Cash A/c

Here, rent is an expense. All expenses have debit balance. Hence, rent is debited. On the other hand, as rent is paid in cash that reduces the cash balances, so cash account is credited.

3. Liability- Liability is an obligation of business. Increase in liability is credited and decrease in liability is debited.

For example, loan taken from bank. The journal entry is:

Bank A/c Dr.

To Bank Loan A/c

Here, loan from bank is a liability to the firm. As all liabilities have credit balance, so loan from bank has been credited because it increases the liabilities.

4. Income- Income means profit earned during an accounting period from any source. Income also means excess of revenue over its cost during an accounting period. Income has credit balance because it increases the balance of capital.

For example, rent received from tenant. The journal entry is:

Cash A/c Dr.

To Rent A/c

Here, rent is an income; hence, rent account has been credited and cash has been debited, as rent received increases the cash balances.

5. Capital- Capital is the amount invested by the proprietor in the business. Capital has credit balance. Increase in capital is credited and decrease in capital is debited

For example, additional capital introduced by owner. The journal entry is:

Cash A/c Dr.

To Capital A/c

As additional capital is introduced, so the amount of capital will increase, i.e. why, capital account is credited. On the other hand, as capital is introduced in form of cash, so the cash balances decrease, i.e. why, cash account is debited.

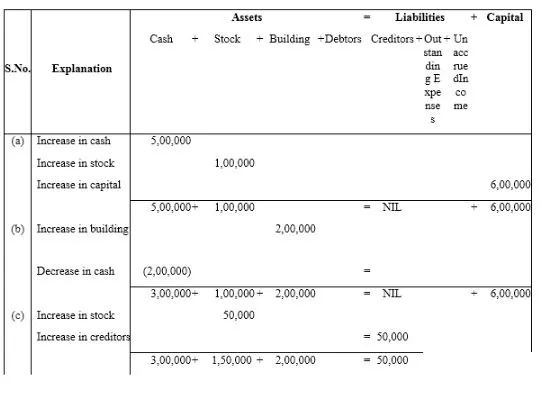

Describe how accounts are used to record information about the effects of transactions?

Every transaction is recorded in the original book of entry (journal) in order of their occurrence; however, if we want to know that how much we receive from our debtors or how much to pay to the creditors, it is not possible to determine at a single movement. Hence, we prepare accounts to know the position of business activities in the meantime.

There are some steps to record transactions in accounts; it can be easily understood with the help of an example.

Sold goods to Mr A worth Rs 50,000 on 12th April and received payment Rs 40,000 on 25th April. The following journal entries will be recorded:

.webp)

Step 1- Locate the account in ledger, i.e., Mr A’s Account.

Step 2- Enter the date of transaction in the date column of the debit side of Mr A’s Account.

Step 3- In the ‘Particulars’ column of the debit side of Mr A’s Account, the name of corresponding account is to be written, i.e., ‘Sales’.

Step 4- Enter the page number of the ledger in the Journal Folio (J.F.) column of Mr A’s Account.

Step 5- Enter the amount in the ‘Amount’ column.

Step 6- Same steps are to be followed to post entries in the credit side of Mr A’s Account.

Step 7- After entering all the transactions for a particular period, balance the account by

totalling both sides and write the difference in shorter side, as ‘Balance c/d’.

Step 8- Total of account is to be written on either sides.

What is a journal? Give a specimen of journal showing at least five entries.

Journal is derived from the French word Jour, means daily records. In this book, transactions are recorded in order of their occurrence, i.e., in chronological order from the source document. It is also termed as the book of original entry and each transaction is termed as journal entry.

Date- Date of transaction is recorded in the order of their occurrence.

Particulars- Details of business transactions like, name of the parties involved and the name of related accounts, are recorded.

L.F.- Page number of ledger account when entry is posted.

Debit Amount- Amount of debit account is written.

Credit Amount- Amount of credit account is written.

Differentiate between source documents and vouchers.

Admissions Open for 2025-26