NCERT Solutions for Class 11 Accounts Chapter 6: Trial Balance and Rectification of Errors Importance of Trial Balance

NCERT Solutions for Class 11 Accounts Chapter 6: Trial Balance and Rectification of Errors introduce the students to a significant tool to check the accuracy of ledger accounts, called the trial balance. The chapter of Class 11 Accounts Trial Balance and Rectification of Errors is concerned with the preparation of and the importance of trial balance, that ensures the total of debits is equal to the total of credits. It is essential that the student understand steps in the preparation of the basic financial statements and in discovering errors in the accounting records. Correcting Errors

Download PDF For NCERT Solutions for Accountancy Trial Balance and Rectification of Errors Importance of Trial Balance

The NCERT Solutions for Class 11 Accounts Chapter 6: Trial Balance and Rectification of Errors Importance of Trial Balance are tailored to help the students master the concepts that are key to success in their classrooms. The solutions given in the PDF are developed by experts and correlate with the CBSE syllabus of 2023-2024. These solutions provide thorough explanations with a step-by-step approach to solving problems. Students can easily get a hold of the subject and learn the basics with a deeper understanding. Additionally, they can practice better, be confident, and perform well in their examinations with the support of this PDF.

Download PDF

Access Answers to NCERT Solutions for Class 11 Accounts Chapter 6: Trial Balance and Rectification of Errors Importance of Trial Balance

Students can access the NCERT Solutions for Class 11 Accounts Chapter 6: Trial Balance and Rectification of Errors Importance of Trial Balance. Curated by experts according to the CBSE syllabus for 2023–2024, these step-by-step solutions make Accountancy much easier to understand and learn for the students. These solutions can be used in practice by students to attain skills in solving problems, reinforce important learning objectives, and be well-prepared for tests.

Trial Balance and Rectification of Errors

What are the methods of preparing trial balance?

A trial balance can be prepared in the following three ways :

-

Totals Method: In this method, the total of the debit and the credit side of the ledger is determined and presented separately in the trial balance. The total of both the sides should match as the accounts are based on double entry system.

-

Balances Method: In this method, the balances of all ledger accounts are presented in their respective debit and credit columns of the trial balance. The total of both the sides should match as the accounts are based on double entry system and this method of preparing a trial balance is widely used because it helps in the preparation of financial statements.

-

Totals-cum-balances Method: This method is a blend of the totals and balances method. This method has four columns. The first two columns are to write the totals of the debits and credits of the various accounts and the other two columns are to write the debit or the credit balances of these accounts. This method is time consuming, and hence are not used widely.

State the meaning of a Trial Balance.

Trial balance is a statement prepared to check the arithmetical accuracy of transactions recorded in the journal, posted into the ledger and balanced in the ledger accounts. The balance of ledger accounts shows the difference between the total of the debit items and credit items in an account. Personal, real and nominal accounts are considered for preparing the trial balance. Generally, it is prepared at the end of an accounting year. However, it may be prepared at the end of any chosen period, which may be monthly, quarterly, half yearly or annually depending upon when it is required. It helps in the preparation of the financial statements.

Give two examples of errors of principle?

Generally accepted accounting principles are to be followed to record the accounting entries. When accounting entries are recorded in contravention of accounting principles, it is known as an error of principle.

-

Wages paid for installation of new machinery debited to wages account:

-

Wages paid for installation of new machinery is a capital expenditure and accordingly machinery account should have been debited. But, here it is treated as revenue expenditure and is debited to wages account. Thus, it violates the accounting principle.

-

Amount spent on repair of building debited to machinery account: Expense on repair is revenue expenditure and not a capital expenditure. The amount should have been debited to repairs account and to the machinery account which is a capital account. Thus, it violates the accounting principle.

Give two examples of errors of commission?

Errors of commission are committed because of wrong recording, wrong posting, wrong balancing and wrong casting of subsidiary books. Such errors affect the accuracy of the trial balance.

-

Cash received from a creditor worth Rs.5,000 is recorded in the cash book as Rs.500.

The transaction is recorded in the cashbook as Rs.500 instead of Rs.5,000. This is an error because of the wrong recording of amount in the cash book. -

Amount received from Arun Rs.2,000, is wrongly posted in Tarun’s account.

In this transaction, Tarun’s A/c is credited instead of Arun’s A/c. This is referred to as an error of wrong posting of transactions.

What are the steps taken by an accountant to locate the errors in the trial balance?

Steps to identify the errors:

-

Recast the totals of the debit and credit columns of the trial balance.

-

Compare each account head and its amount appearing in the trial balance with that of the ledger to detect any difference in amount or omission of any account.

-

Compare the trial balance of the current year with that of the previous year to check the additions or deletions to any accounts and to verify if there is any unexplained difference in amounts.

-

Re-check the correctness of balances of individual accounts in their respective ledgers.

-

Re-check the accuracy of the postings in individual accounts from the transactions entered in the books of original entry.

-

If the difference between the debit and credit columns is of `1, `10, `100 or `1000, the casting of the subsidiary books should be re-checked.

-

If the difference between the debit and credit columns is divisible by 2, then there is a possibility that an amount equal to half the difference may have been posted to the wrong side of another ledger account.

-

The above point may also indicate a complete omission of a posting.

-

If the difference is divisible by 9, the mistake could be because of transposition of figures.

-

Still, if it is not possible to locate the errors, the difference in the trial balance for that moment is transferred to the suspense account. All the one-sided errors detected are rectified through this account.

What is a suspense account? Is it necessary that suspense account will balance off after rectification of the errors detected by the accountant? If not, then what happens to the balance still remaining in suspense account?

In certain cases, when the debit column and the credit column of a trial balance do not agree, then the difference of the trial balance is transferred to a temporary account which is called a suspense account. This account is created to avoid any delay in creation of the financial statements. If the debit column falls short of the credit column, then the suspense account is debited and if the credit column falls short of the debit column then the suspense account is credited.

When all the errors are detected and rectified, then the suspense account automatically gets balanced. However, when errors still exist and are not rectified, the suspense account will not balance off and the balance amount of the suspense account will have to be transferred to the balance sheet. The debit balance of the suspense account is shown on the assets side and the credit balance is shown on the liabilities side of the balance sheet.

What kinds of errors would cause difference in the trial balance? Also list examples that would not be revealed by a trial balance?

One-sided errors are the errors which when committed affect the agreement of the trial balance. These errors affect only one account and any one side i.e. debit or the credit side of the account. Errors of partial omission, recording transactions with wrong amount, casting, posting of incorrect amount are examples of one-sided errors.

Two-sided errors do not affect the agreement of the trial balance. Here, are a few examples which would not be revealed in a trial balance:

-

Purchases from Mr. Shah, completely omitted to be recorded in the purchase book.

-

Purchases made from Vijesh, recorded in Ritesh’s account who is another creditor.

-

Stationary purchased for office use recorded in the purchase book.

Describe the purpose for the preparation of trial balance.

The important purposes for which the trial balance was prepared are explained with the help of the following points:

-

Ascertain the arithmetical accuracy of ledger accounts – The trial balance helps to ascertain whether all the debits and credits are properly recorded in the ledger. When the debit and the credit balances are equal, it is said that the posting and the balancing of the accounts is arithmetically correct. However, the tallying of the trial balance cannot be considered as a conclusive proof of accuracy of the books.

-

Helps in locating errors – When a trial balance does not tally, it helps in detecting or locating the errors. The error may have occurred at any one of the stages of an accounting process; namely,

-

Totaling of the subsidiary books

-

Posting of journal entries in the ledger

-

Calculating account balances

-

Carrying account balances to the trial balance

-

Totaling the trial balance columns

-

Helps in the preparation of the financial statements – Trial balance is a statement which lists the debit and credit balances of all ledger accounts and helps in the preparation of the financial statements. Hence, it is considered as a connecting link between the accounting records and the preparation of financial statements.

Explain errors of principle and give two examples with measures to rectify them.

Generally accepted accounting principles are to be followed to record the accounting entries. When accounting entries are recorded violating or ignoring these principles, the error, thus, committed is known as error of principle. These errors do not affect the agreement of the trial balance.

Wages paid for construction of building are debited to wages account.

Wrong entry:

|

Wages A/c |

Dr. |

|

|

To Cash A/c |

||

|

(Being wages paid for construction of building) |

||

Wages paid for the construction of building is to be treated as a capital expenditure and has to be debited to the building account instead of the wages account. Thus, the correct entry is

|

Building A/c |

Dr. |

|

|

To Cash A/c |

||

|

(Being wages paid for construction of building) |

||

Hence, to rectify the error Building A/c needs to be debited and Wages A/c needs to be credited as it was wrongly debited. The rectifying entry is:

|

Building A/c |

Dr. |

|

|

To Wages A/c |

||

|

(Being wages paid for construction of building wrongly debited to wages account, now rectified) |

||

Furniture purchased for Rs.10,000 wrongly debited to purchases account.

Wrong entry made:

|

Purchase A/c |

Dr. |

|

|

To Cash A/c |

||

|

(Being furniture purchased wrongly debited to purchases account) |

||

Furniture is an asset and the purchase of the same should be debited to furniture account instead of purchases account. Thus, the correct entry is:

|

Furniture A/c |

Dr. |

|

|

To Cash A/c |

||

|

(Being old machinery sold for cash) |

||

To rectify this error, Furniture A/c needs to be debited and Purchase A/c needs to be credited as it is wrongly debited. Thus, the rectifying entry is:

|

Furniture A/c |

Dr. |

|

|

To Purchase A/c |

||

|

(Being furniture purchased for wrongly debited to purchases account, now rectified) |

||

Explain the errors of commission and give two examples with measures to rectify them.

The errors which are committed because of wrong posting of transactions, wrong balancing of accounts, wrong casting of subsidiary books, wrong totaling or wrong recording of amount in the books are all error of commission. These errors affect the agreement of the trial balance.

1. Purchases done from Rohan worth Rs.10,000 recorded as Rs.1,000.

Here, the transaction is recorded for Rs.1,000 instead of Rs.10,000. This is an error of wrong recording of amount. Purchases A/c requires a further debit of Rs.9,000 and Rohan’s A/c requires a further credit of Rs.9,000.The rectifying entry is:

|

Purchases A/c |

Dr. |

9,000 |

||

|

To Rohan’s A/c |

9,000 |

|||

|

(Being goods purchased from Rohan of Rs.10,000 wrongly recorded as Rs.1,000, now rectified) |

||||

2. Sales book totaled as Rs.5,000 instead of Rs.50,000.

Here, the total sales of the book are short by Rs.45,000. This error can be rectified at any of the following two stages:

-

If the error is located before preparing trial balance, then Rs.45,000 should be recorded in the credit side of Sales Account.

-

If an error is located after preparing Trial Balance, then assuming that a suspense account is opened the following entry needs to be recorded.

|

Suspense A/c |

Dr. |

45,000 |

||

|

To Sales A/c |

45,000 |

|||

|

(Being sales book wrongly totaled as Rs.5,000 instead of Rs.50,000) |

||||

What are the different types of errors that are usually committed in recording business transactions?

According to the nature of errors committed, errors are classified into the following four categories:

-

Errors of Commission: The errors that are committed because of wrong posting of transactions, wrong balancing of accounts, wrong casting of subsidiary books, wrong totaling or wrong recording of amount in the books are all errors of commission. These errors affect the agreement of the trial balance.

-

Errors of Omission: These errors are of two types and are committed when a transaction is partially or completely omitted to be recorded in the books.

-

Error of complete omission – When a transaction is completely omitted to be recorded in the books of accounts or to be posted in the respective ledgers, it is an error of complete omission. Such errors do not affect the agreement of the trial balance.

-

Error of partial omission – When a transaction is partially omitted while recording in the books or amounts or partially omitted from posting in the ledger, it is an error of partial omission. Such errors affect the agreement of the trial balance.

-

Errors of Principle: Accounting transactions are to be recorded following certain principles. If any of the principle of accounting entries are violated or ignored and the error occurring due to such violation is called error of principle.

-

Compensating errors: When two or more errors are committed in such a way that the net effect of these errors on the debits and credits of accounts is nil, such errors are called compensating errors.

As an accountant of a company, you are disappointed to learn that the totals in your new trial balance are not equal. After going through a careful analysis, you have discovered only one error. Specifically, the balance of the Office Equipment account has a debit balance of Rs.15,600 on the trial balance. However, you have figured out that a correctly recorded credit purchase of pen-drive for Rs.3,500 was posted from the journal to the ledger with a Rs.3,500 debit to Office Equipment and another Rs.3,500 debit to creditors accounts. Answer each of the following questions and present the amount of any misstatement:

(a) Is the balance of the office equipment account overstated, understated, or correctly stated in the trial balance?

(b) Is the balance of the creditors account overstated, understated, or correctly stated in the trial balance?

(c) Is the debit column total of the trial balance overstated, understated, or correctly stated?

(d) Is the credit column total of the trial balance overstated, understated, or correctly stated?

(e) If the debit column total of the trial balance is Rs.2,40,000 before correcting the error, what is the total of the credit column?

Pen-drive is wrongly debited to office equipment account, instead of stationery account and supplier account is debited instead of crediting. Because of these mistakes, the following errors are committed:

a. The balance of office equipment is overstated by Rs.3,500

b. The balance of creditors account is understated by Rs.7,000

c. The total of the debit column of the trial balance is correctly stated.

d. The total of the credit column of the trial balance is understated by Rs.7,000.

e. If the total of the debit column of the trial balance is Rs.2,40,000 before rectifying error, the total of the credit column of the trial balance is Rs.2,33,000 (i.e., Rs.2,40,000 – Rs.7,000).

Numerical Questions

Rectify the following errors:

-

Sales book overcast by ₹ 700.

-

Purchases book overcast by ₹ 500.

-

Sales return book overcast by ₹ 300.

-

Purchase returns book overcast by ₹ 200.

_20241111_102344.webp)

Note:

It is assumed that the suspense account is opened to rectify the errors in the trial balance.

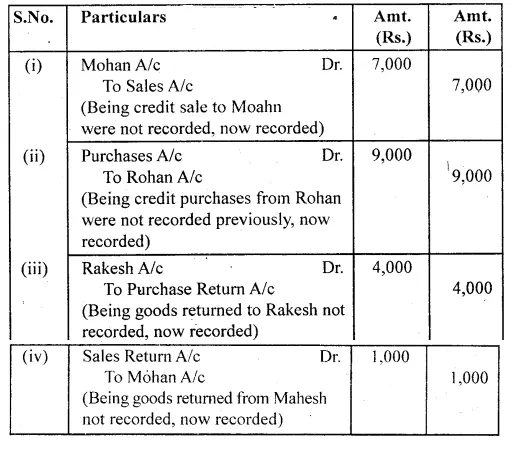

Rectify the following errors:

-

Credit sales to Mohan ₹ 7,000 were not recorded.

-

Credit purchases from Rohan ₹ 9,000 were not recorded.

-

Goods returned to Rakesh ₹ 4,000 were not recorded.

-

Goods returned from Mahesh ₹ 1,000 were not recorded.

Rectify the following errors:

-

Credit sales to Mohan ₹ 7,000 were recorded as ₹ 700.

-

Credit purchases from Rohan ₹ 9,000 were recorded as ₹ 900.

-

Goods returned to Rakesh ₹ 4,000 were recorded as ₹ 400.

-

Goods returned from Mahesh ₹ 1,000 were recorded as ₹ 100.

_20241111_101852.webp)

Rectify the following errors:

-

Credit sales to Mohan ₹ 7,000 were recorded as ₹ 7,200.

-

Credit purchases from Rohan ₹ 9,000 were recorded as ₹ 9,900.

-

Goods returned to Rakesh ₹ 4,000 were recorded as ₹ 4,040.

-

Goods returned from Mahesh ₹ 1,000 were recorded as ₹ 1,600.

_20241111_101952.webp)

Rectify the following errors:

-

Salary paid ₹ 5,000 was debited to employee’s personal account.

-

Rent paid ₹ 4,000 was posted to landlord’s personal account.

-

Goods withdrawn by proprietor for personal use ₹ 1,000 were debited to sundry expenses account.

-

Cash received from Kohli ₹ 2,000 was posted to Kapur’s account.

-

Cash paid to Babu ₹ 1,500 was posted to Sabu’s account.

_20241111_102123.webp)

Rectify the following errors:

-

Credit Sales to Mohan ₹ 7,000 were recorded in purchases book.

-

Credit Purchases from Rohan ₹ 900 were recorded in sales book.

-

Goods returned to Rakesh ₹ 4,000 were recorded in the sales return book.

-

Goods returned from Mahesh ₹ 1,000 were recorded in purchases return book.

-

Goods returned from Mahesh ₹ 2,000 were recorded in purchases book.

_20241111_102228.webp)

Rectify the following errors:

-

Sales book undercast by ₹ 300.

-

Purchases book undercast by ₹ 400.

-

Return inwards book undercast by ₹ 200.

-

Return outwards book undercast by ₹ 100.

_20241111_102454.webp)

Note:

It is assumed that the suspense account is opened to rectify the errors in the trial balance.

Rectify the following errors and ascertain the amount of difference in trial balance by preparing suspense account:

-

Credit sales to Mohan ₹ 7,000 were not posted.

-

Credit purchases from Rohan ₹ 9,000 were not posted.

-

Goods returned to Rakesh ₹ 4,000 were not posted.

-

Goods returned from Mahesh ₹ 1,000 were not posted.

-

Cash paid to Ganesh ₹ 3,000 was not posted.

-

Cash sales ₹ 2,000 were not posted.

_20241111_102634.webp)

Rectify the following errors and ascertain the amount of difference in trial balance by preparing suspense account:

-

Credit sales to Mohan ₹ 7,000 were posted as ₹ 9,000.

-

Credit purchases from Rohan ₹ 9,000 were posted as ₹ 6,000.

-

Goods returned to Rakesh ₹ 4,000 were posted as ₹ 5,000.

-

Goods returned from Mahesh ₹ 1,000 were posted as ₹ 3,000.

-

Cash sales ₹ 2,000 were posted as ₹ 200.

_20241111_102801.webp)

_20241111_102751.webp)

Rectify the following errors:

-

Credit sales to Mohan ₹ 7,000 were posted to Karan.

-

Credit purchases from Rohan ₹ 9,000 were posted to Gobind

-

Goods returned to Rakesh ₹ 4,000 were posted to Naresh.

-

Goods returned from Mahesh ₹ 1,000 were posted to Manish.

-

Cash sales ₹ 2,000 were posted to commission account.

_20241111_102919.webp)

Rectify the following errors assuming that a suspense account was opened.Ascertain the difference in trial balance.

-

Credit sales to Mohan ₹ 7,000 were posted to the credit of his account.

-

Credit purchases from Rohan ₹ 9,000 were posted to the debit of his account as ₹ 6,000.

-

Goods returned to Rakesh ₹ 4,000 were posted to the credit of his account.

-

Goods returned from Mahesh ₹ 1,000 were posted to the debit of his account as ₹ 2,000.

-

Cash sales of ₹ 2,000 were posted to the debit of sales account as ₹ 5,000.

_20241111_103029.webp)

_20241111_103143.webp)

Rectify the following errors assuming that a suspense account was opened. Ascertain the difference in trial balance.

-

Credit sales to Mohan ₹ 7,000 were posted to Karan as ₹ 5,000.

-

Credit purchases from Rohan ₹ 9,000 were posted to the debit of Gobind as ₹ 10,000.

-

Goods returned to Rakesh ₹ 4,000 were posted to the credit of Naresh as ₹ 3,000.

-

Goods returned from Mahesh ₹ 1,000 were posted to the debit of Manish as ₹ 2,000.

-

Cash sales ₹ 2,000 were posted to commission account as ₹ 200.

_20241111_103338.webp)

_20241111_103345.webp)

Rectify the following errors assuming that the suspense account was opened. Ascertain the difference in trial balance.

-

Credit sales to Mohan ₹ 7,000 were recorded in the Purchase Book. However, Mohan’s account was correctly debited.

-

Credit purchases from Rohan ₹ 9,000 were recorded in the sales book. However, Rohan’s account was correctly credited.

-

Goods returned to Rakesh ₹ 4,000 were recorded in the sales return book. However, Rakesh’s account was correctly debited.

-

Goods returned from Mahesh ₹ 1,000 were recorded through purchases return book. However, Mahesh’s account was correctly credited.

-

Goods returned to Naresh ₹ 2,000 were recorded through purchases book. However, Naresh’s account was correctly debited.

_20241111_103625.webp)

_20241111_103547.webp)

_20241111_103722.webp)

Rectify the following errors:

-

Furniture purchased for ₹ 10,000 wrongly debited to purchases account.

-

Machinery purchased on credit from Raman for ₹ 20,000 was recorded through purchases book.

-

Repairs on machinery ₹ 1,400 debited to machinery account.

-

Repairs on overhauling of second hand machinery purchased ₹ 2,000 was debited to repairs account.

-

Sale of old machinery at book value of ₹ 3,000 was credited to sales account.

_20241111_103917.webp)

Rectify the following errors assuming that the suspense account was opened. Ascertain the difference in trial balance.

-

Furniture purchased for ₹ 10,000 wrongly debited to purchase account as ₹ 4,000.

-

Machinery purchased on credit from Raman for ₹ 20,000 recorded through Purchases Book as ₹ 6,000.

-

Repairs on machinery ₹ 1,400 debited to Machinery account as ₹ 2,400.

-

Repairs on overhauling of second hand machinery purchased ₹ 2,000 ₹ 200.

-

Sale of old machinery at book value ₹ 3,000 was credited to sales account as ₹ 5,000.

_20241111_103922.webp)

_20241111_103927.webp)

Rectify the following errors :

-

Depreciation provided on machinery ₹ 4,000 was not posted.

-

Bad debts written off ₹ 5,000 were not posted.

-

Discount allowed to a debtor ₹ 100 on receiving cash from him was not posted.

-

Discount allowed to a debtor ₹ 100 on receiving cash from him was not posted to discount account.

-

Bill receivable for ₹ 2,000 received from a debtor was not posted.

_20241111_104229.webp)

Rectify the following errors:

-

Depreciation provided on machinery ₹ 4,000 was posted as ₹ 400.

-

Bad debts written off ₹ 5,000 were posted as ₹ 6,000.

-

Discount allowed to a debtor ₹ 100 on receiving cash from him was posted as ₹ 60.

-

Goods withdrawn by proprietor for personal use ₹ 800 were posted as ₹ 300.

-

Bill receivable for ₹ 2,000 received from a debtor was posted as ₹ 3,000.

_20241111_104235.webp)

Rectify the following errors assuming that suspense account was opened. Ascertain the difference in trial balance.

-

Depreciation provided on machinery ₹ 4,000 was not posted to Depreciation account.

-

Bad debts written-off ₹ 5,000 were not posted to Debtors account.

-

Discount allowed to a debtor ₹ 100 on receiving cash from him was not posted to discount allowed account.

-

Goods withdrawn by proprietor for personal use ₹ 800 were not posted to Drawings account.

-

Bill receivable for ₹ 2,000 received from a debtor was not posted to Bills receivable account.

_20241111_104240.webp)

_20241111_104248.webp)

Trial balance of Anuj did not agree. It showed an excess credit of ₹ 6,000. He put the difference to suspense account. He discovered the following errors:

-

Cash received from Ravish ₹ 8,000 posted to his account as ₹ 6,000.

-

Returns inwards book overcast by ₹ 1,000.

-

Total of sales book ₹ 10,000 was not posted to Sales account.

-

Credit purchases from Nanak ₹ 7,000 were recorded in sales Book. However, Nanak’s account was correctly credited.

-

Machinery purchased for ₹ 10,000 was posted to purchases account as ₹ 5,000. Rectify the errors and prepare suspense account.

_20241111_104936.webp)

_20241111_105024.webp)

Trial balance of ₹ 10,000. He put the difference to suspense account and discovered the following errors:

-

Depreciation written-off the furniture ₹ 6,000 was not posted to Furniture account.

-

Credit sales to ₹ 10,000 were recorded as ₹ 7,000.

-

Purchases book undercast by ₹ 2,000.

-

Cash sales to ₹ 5,000 were not posted.

-

Old Machinery sold for ₹ 7,000 was credited to sales account.

-

Discount received ₹ 800 from Kanan on paying cash to him was not posted.

Rectify the errors and prepare suspense account.

_20241111_105210.webp)

_20241111_105216.webp)

Trial balance of Madan did not agree and he put the difference to suspense account. He discovered the following errors:

-

Sales return book overcast by ₹ 800.

-

Purchases return to ₹ 2,000 was not posted.

-

Goods purchased on credit from ₹ 4,000 though taken into stock, but no entry was passed in the books.

-

Installation charges on new machinery purchased ₹ 500 were debited to sundry expenses account as ₹ 50.

-

Rent paid for residential accommodation of madam (the proprietor) ₹ 1,400 was debited to rent account as ₹ 1,000.

Rectify the errors and prepare suspense account to ascertain the difference in trial balance.

_20241111_105353.webp)

_20241111_105401.webp)

Trial balance of Kohli did not agree and showed an excess debit of ₹ 16,300. He put the difference to a suspense account and discovered the following errors:

-

Cash received from ₹ 5,000 was posted to the debit of Kamal as ₹ 6,000.

-

Salaries paid to an employee ₹ 2,000 were debited to his personal account as ₹ 1,200.

-

Goods withdrawn by proprietor for personal use ₹ 1,000 were credited to sales account as ₹ 1,600.

-

Depreciation provided on machinery ₹ 3,000 was posted to Machinery account as ₹ 300.

-

Sale of old car for ₹ 10,000 was credited to sales account as ₹ 6,000.

Rectify the errors and prepare suspense account.

.webp)

_20241111_105717.webp)

_20241111_105724.webp)

Give journal entries to rectify the following errors assuming that suspense account had been opened.

-

Goods distributed as free sample ₹ 5,000 were not recorded in the books.

-

Goods withdrawn for personal use by the proprietor ₹ 2,000 were not recorded in the books.

-

Bill receivable received from a debtor ₹ 6,000 was not posted to his account

-

Total of returns inwards book ₹ 1,200 was posted to Returns outwards account.

-

Discount allowed to ₹ 700 on receiving cash from her was recorded in the books as ₹ 70.

_20241111_110002.webp)

_20241111_110008.webp)

Trial balance of Khatau did not agree. He put the difference to suspense account and discovered the following errors:

-

Credit sales to ₹ 16,000 were recorded in the purchases book as ₹ 10,000 and posted to the debit of ₹ 1,000.

-

Furniture purchased from Noor ₹ 6,000 was recorded through the purchase book as ₹ 5,000 and posted to the debit of Noor ₹ 2,000.

-

Goods returned to ₹ 3,000 recorded through the Sales book as ₹ 1,000.

-

Old machinery sold for ₹ 2,000 to Maneesh recorded through the sales book as ₹ 1,800 and posted to the credit of Manish as ₹ 1,200.

-

Total of Returns inwards book ₹ 2, 800 posted to Purchase account.

Rectify the above errors and prepare a suspense account to ascertain the difference in trial balance.

_20241111_110014.webp)

_20241111_110019.webp)

Admissions Open for 2025-26